Supplier Diversity Management Engage Diverse Suppliers to Drive Impact

Supplier Diversity Management with Coupa

Explore how our products can enhance, extend, and empower your supplier diversity efforts.

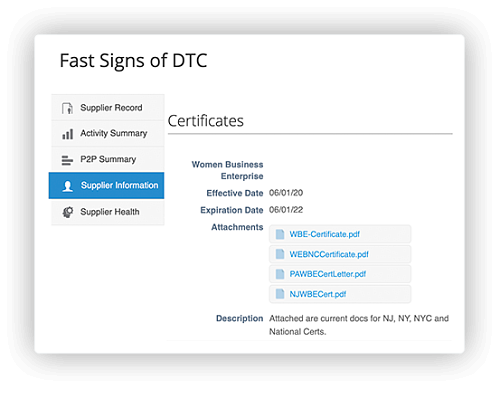

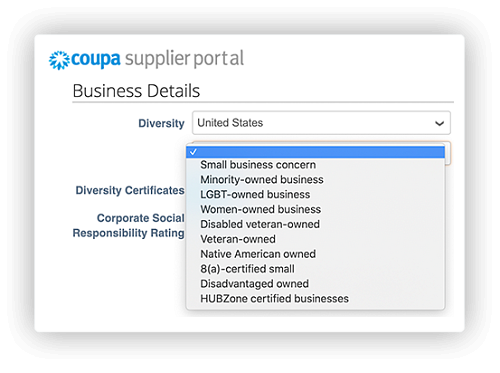

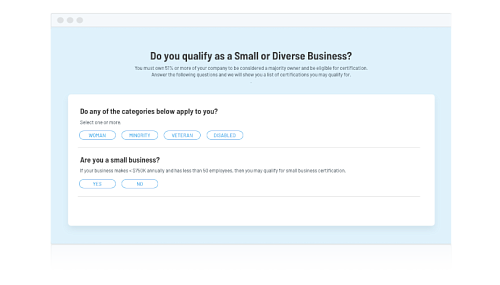

Register Suppliers

Easily register and engage with certified and international suppliers on a user-friendly interface.

Make Connections Anytime, Anywhere

Coupa empowers suppliers to create and maintain secure profiles in one place and gives buyers the ability to reach out at any time.

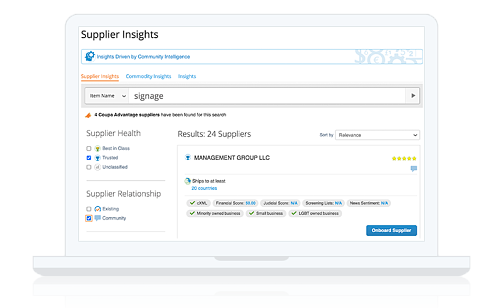

Access a Diverse Supplier Database

Easily find and onboard diverse suppliers directly within Coupa, searching by location, diversity classification, and more. Some of the suppliers in the Diverse Supplier Database have pre-negotiated contracts and are already onboarded and ready to go.

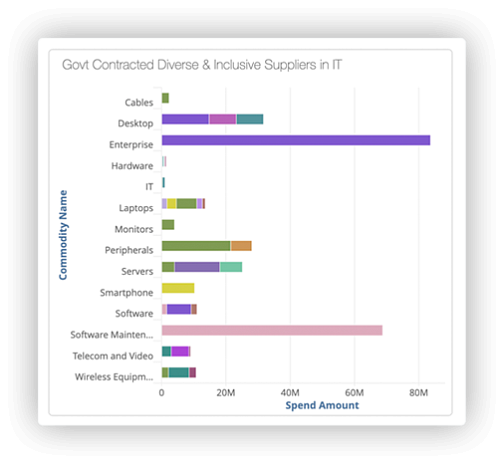

Easily Visualize Impact

Get insight into all types of spend with diverse suppliers to understand and maximize the impact of your D&I programs.

Get Resources for Supplier Development

Coupa provides a one-stop-shop for small and diverse U.S. business certification information and resources.